1 Best Tax Software For The Self-Employed Of September 2022

- Author: forbes.com

- Published Date: 03/07/2022

- Review: 4.81 (753 vote)

- Summary: · State Filing Fee. $39.00. Promotional rate. Standard pricing $49. Why We Picked It

- Source: 🔗

2 Free File Options – WV State Tax Department

- Author: tax.wv.gov

- Published Date: 01/13/2022

- Review: 4.64 (431 vote)

- Summary: Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between

- Source: 🔗

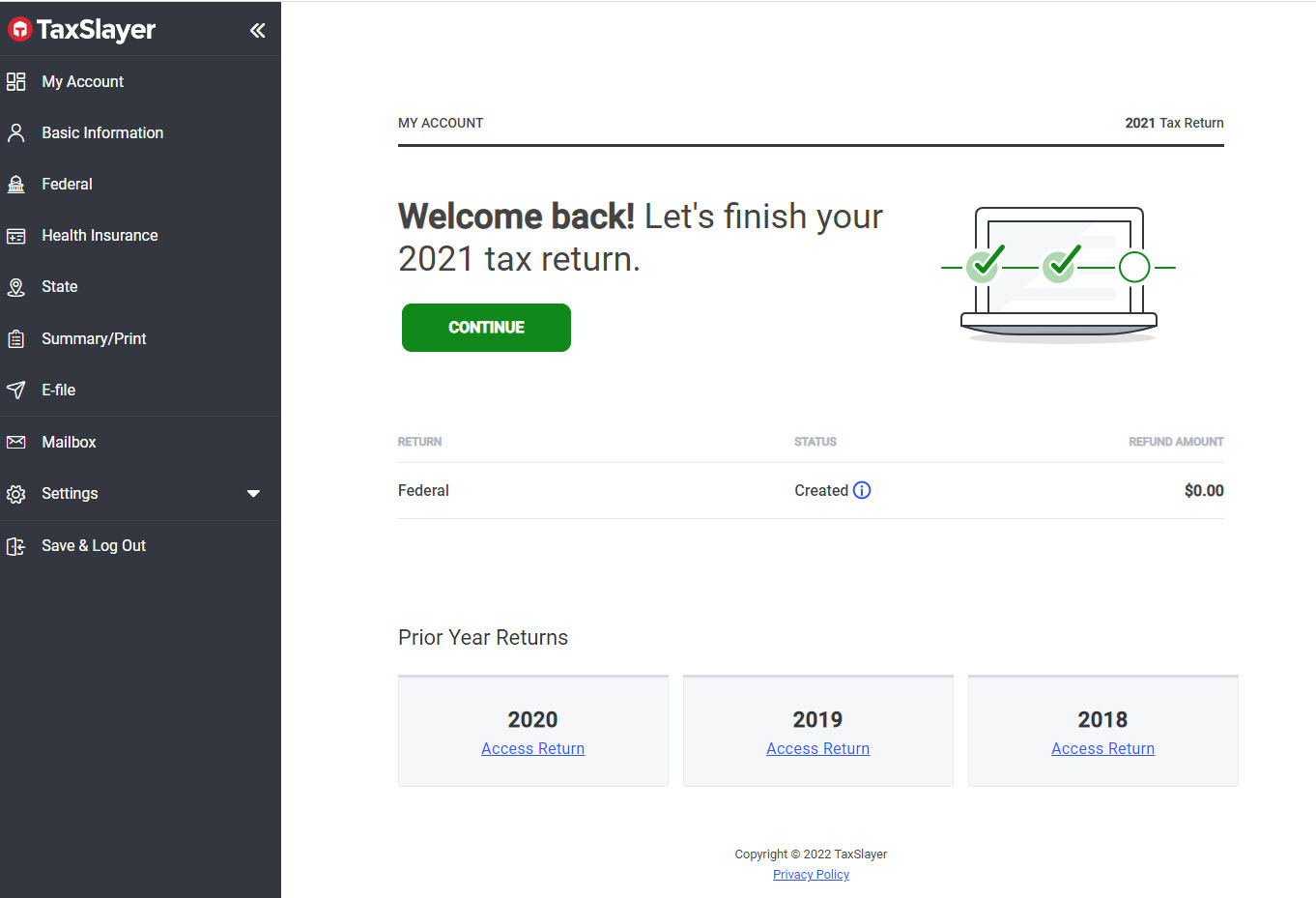

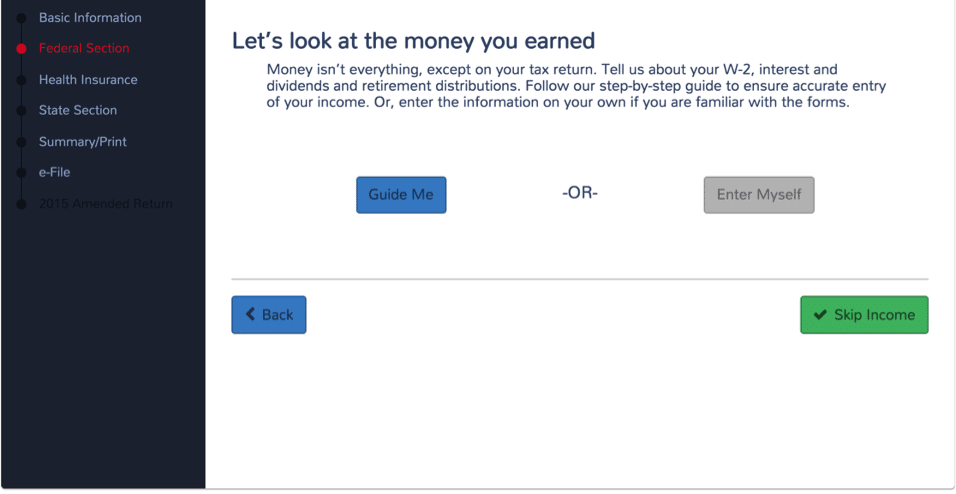

3 TaxSlayer review: A low-cost pick for experienced filers and simple tax situations

- Author: businessinsider.com

- Published Date: 04/10/2022

- Review: 4.41 (588 vote)

- Summary: · TaxSlayer offers four plans for filing taxes online, with varying levels of customer support. · Plans range from $0 to $54.95 for a federal

- Source: 🔗

4 TaxSlayer 2022 (Tax Year 2021) Review – PCMag

- Author: pcmag.com

- Published Date: 10/09/2021

- Review: 4.21 (574 vote)

- Summary: 3.5 · $24.95 · Review by Kathy Yakal

- Matching search results: There’s a difference in the volume of help, too. The best sites offer a variety of help tools on almost every page. TaxSlayer could do more of this. For example, the Schedule C Expenses page would be improved if there were at least links to …

- Source: 🔗

Details

5 TaxSlayer: File your taxes 4+ – App Store

- Author: apps.apple.com

- Published Date: 10/08/2021

- Review: 4.18 (288 vote)

- Summary: Download TaxSlayer: File your taxes and enjoy it on your iPhone, iPad, … but I didn’t want to pay until I was sure it would then take the correct amount,

- Matching search results: There’s a difference in the volume of help, too. The best sites offer a variety of help tools on almost every page. TaxSlayer could do more of this. For example, the Schedule C Expenses page would be improved if there were at least links to …

- Source: 🔗

6 Available On-Line Filing | DOR – Mississippi Department of Revenue

- Author: dor.ms.gov

- Published Date: 05/15/2022

- Review: 3.99 (431 vote)

- Summary: IRS Free File. 1040Now. On Line Taxes. TaxAct. FreeTaxUSA, TaxSlayer … https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

- Matching search results: There’s a difference in the volume of help, too. The best sites offer a variety of help tools on almost every page. TaxSlayer could do more of this. For example, the Schedule C Expenses page would be improved if there were at least links to …

- Source: 🔗

7 TaxSlayer Review – 2022 – Chamber of Commerce.org

- Author: chamberofcommerce.org

- Published Date: 10/23/2021

- Review: 3.76 (456 vote)

- Summary: TaxSlayer has a free option, and unlike those offered by many competing tax software companies, it really is free

- Matching search results: TaxSlayer has two visible weaknesses. The first is relatively watered-down customer support. The chat feature only covers tech support (so you can’t get tax support through chat). If you want tax help from a human, you’ll have to purchase the …

- Source: 🔗

Details

8 TaxSlayer Review: A Low-Cost Choice for Filing Taxes

- Author: business.org

- Published Date: 12/07/2021

- Review: 3.45 (401 vote)

- Summary: · The paid classic version of TaxSlayer’s software works for all income ranges, and it costs $24.95 for the federal tax form,

- Matching search results: TaxSlayer has two visible weaknesses. The first is relatively watered-down customer support. The chat feature only covers tech support (so you can’t get tax support through chat). If you want tax help from a human, you’ll have to purchase the …

- Source: 🔗

9 TaxSlayer Review 2022 – SmartAsset.com

- Author: smartasset.com

- Published Date: 05/27/2022

- Review: 3.2 (375 vote)

- Summary: 4.2 · Review by Emily Zhu

- Matching search results: TaxSlayer has two visible weaknesses. The first is relatively watered-down customer support. The chat feature only covers tech support (so you can’t get tax support through chat). If you want tax help from a human, you’ll have to purchase the …

- Source: 🔗

10 TaxSlayer Review [2022]: How it Works, How Much it Costs, and Who its Right for

- Author: financebuzz.com

- Published Date: 06/24/2022

- Review: 3.1 (361 vote)

- Summary: Starting at just $17.95, the TaxSlayer Classic also covers one federal and state tax return, with

- Matching search results: With helpful extras like 1099 and Schedule C support, plus additional tax tips, reminders, and resources, this plan is perfect for anyone who’s filing as a sole proprietor or business owner. Not only can this plan help you find and take advantage …

- Source: 🔗

Details

11 TaxSlayer Review – Filing Options for Every Budget

- Author: doughroller.net

- Published Date: 04/21/2022

- Review: 2.81 (195 vote)

- Summary: This is TaxSlayer’s most popular plan. The fee for this edition is $17, plus $29 for each state

- Matching search results: This edition is for more complicated tax returns, and comes with a price of $37 for the federal return, plus $29 for each additional state return filed. The plan provides support for all deductions, credits, and forms, but also adds direct help from …

- Source: 🔗

Details

12 Top 322 TaxSlayer Reviews – ConsumerAffairs.com

- Author: consumeraffairs.com

- Published Date: 10/06/2021

- Review: 2.69 (92 vote)

- Summary: How much does TaxSlayer cost? · The Simply Free option is the most basic and lets you file federal taxes and one state tax return for free. · The Classic option

- Matching search results: This edition is for more complicated tax returns, and comes with a price of $37 for the federal return, plus $29 for each additional state return filed. The plan provides support for all deductions, credits, and forms, but also adds direct help from …

- Source: 🔗

13 Best Tax Software of 2022 – Investopedia

- Author: investopedia.com

- Published Date: 02/06/2022

- Review: 2.73 (193 vote)

- Summary: According to a report from the National Society of Accountants, the average cost to have a professional preparer complete your taxes ranges from $176 to

- Matching search results: This edition is for more complicated tax returns, and comes with a price of $37 for the federal return, plus $29 for each additional state return filed. The plan provides support for all deductions, credits, and forms, but also adds direct help from …

- Source: 🔗

14 TaxSlayer Review: Quick and Affordable Tax Preparation

- Author: themilitarywallet.com

- Published Date: 10/12/2021

- Review: 2.56 (162 vote)

- Summary: · TaxSlayer offers four pricing plans: … For all the paid plans, you’ll need to pay an additional $36.95 to file a state return. These are very

- Matching search results: This edition is for more complicated tax returns, and comes with a price of $37 for the federal return, plus $29 for each additional state return filed. The plan provides support for all deductions, credits, and forms, but also adds direct help from …

- Source: 🔗

Details

15 TaxSlayer 2022 Review: Best Online Tax Software for Self-Employed

- Author: cnet.com

- Published Date: 04/08/2022

- Review: 2.51 (134 vote)

- Summary: · TaxSlayer’s Self-Employed tax preparation service costs $60 for a federal tax return and $40 for each state tax return. The Self-Employed tier

- Matching search results: TaxSlayer’s excellent value for gig workers helped it earn our top pick for freelancers, gig workers and self-employed filers in our roundup of best tax software of 2022. Even if you’re a salaried W-2 employee, TaxSlayer provides an attractive …

- Source: 🔗

Details

16 TaxSlayer Review 2022 – NerdWallet

- Author: nerdwallet.com

- Published Date: 07/12/2022

- Review: 2.39 (58 vote)

- Summary: 3.5

- Matching search results: TaxSlayer’s excellent value for gig workers helped it earn our top pick for freelancers, gig workers and self-employed filers in our roundup of best tax software of 2022. Even if you’re a salaried W-2 employee, TaxSlayer provides an attractive …

- Source: 🔗

17 Free File your income tax return

- Author: tax.ny.gov

- Published Date: 02/07/2022

- Review: 2.29 (98 vote)

- Summary: · … your federal and New York State income tax returns—at no cost. … All I had to do was enter the information from my W-2 and 1099-T

- Matching search results: TaxSlayer’s excellent value for gig workers helped it earn our top pick for freelancers, gig workers and self-employed filers in our roundup of best tax software of 2022. Even if you’re a salaried W-2 employee, TaxSlayer provides an attractive …

- Source: 🔗

18 TaxSlayer Review 2022 – Free Tax Filing & Online Return Preparation

- Author: moneycrashers.com

- Published Date: 12/23/2021

- Review: 2.12 (194 vote)

- Summary: This plan costs $17.95 for your federal tax return and $36.95 for each state tax return. It includes support for all

- Matching search results: TaxSlayer doesn’t blow competition like TurboTax and H&R Block out of the water, but it’s superior in several crucial ways. Most notably, it’s cheaper than many better-known alternatives. If cost is a critical consideration in choosing an online …

- Source: 🔗

Details

19 TaxSlayer Review: Features & Pricing in 2022

- Author: fitsmallbusiness.com

- Published Date: 03/20/2022

- Review: 2.1 (108 vote)

- Summary: · TaxSlayer offers a free version that lets you file simple returns for no cost, as well as three paid packages that range from $24.95 to $54.95

- Matching search results: With the exception of the Simply Free plan, TaxSlayer guarantees that you’ll receive the maximum refund that you’re entitled to, or it’ll refund your purchase. To qualify, you must be able to show that the larger refund or smaller tax due cannot be …

- Source: 🔗

Details