1 QuickBooks Self-Employed Review 2022 – Merchant Maverick

- Author: merchantmaverick.com

- Published Date: 01/01/2022

- Review: 4.83 (919 vote)

- Summary: 4.0 · Review by Erica Seppala

- Matching search results: QuickBooks is generally notorious for poor customer support. However, although QuickBooks Self-Employed is missing phone support, QBSE is trying to break the mold and offer decent, quick support options. There is a built-in live chat feature that is …

- Source: 🔗

Details

2 QuickBooks Self-Employed Review: Pros and Cons – CreditDonkey

- Author: creditdonkey.com

- Published Date: 10/07/2021

- Review: 4.62 (211 vote)

- Summary: · Pricing ; QuickBooks Self-Employed Plan Cost: $15/month (50% discount for the first 3 months) ; QuickBooks Self-Employed Tax Bundle Cost: $25/

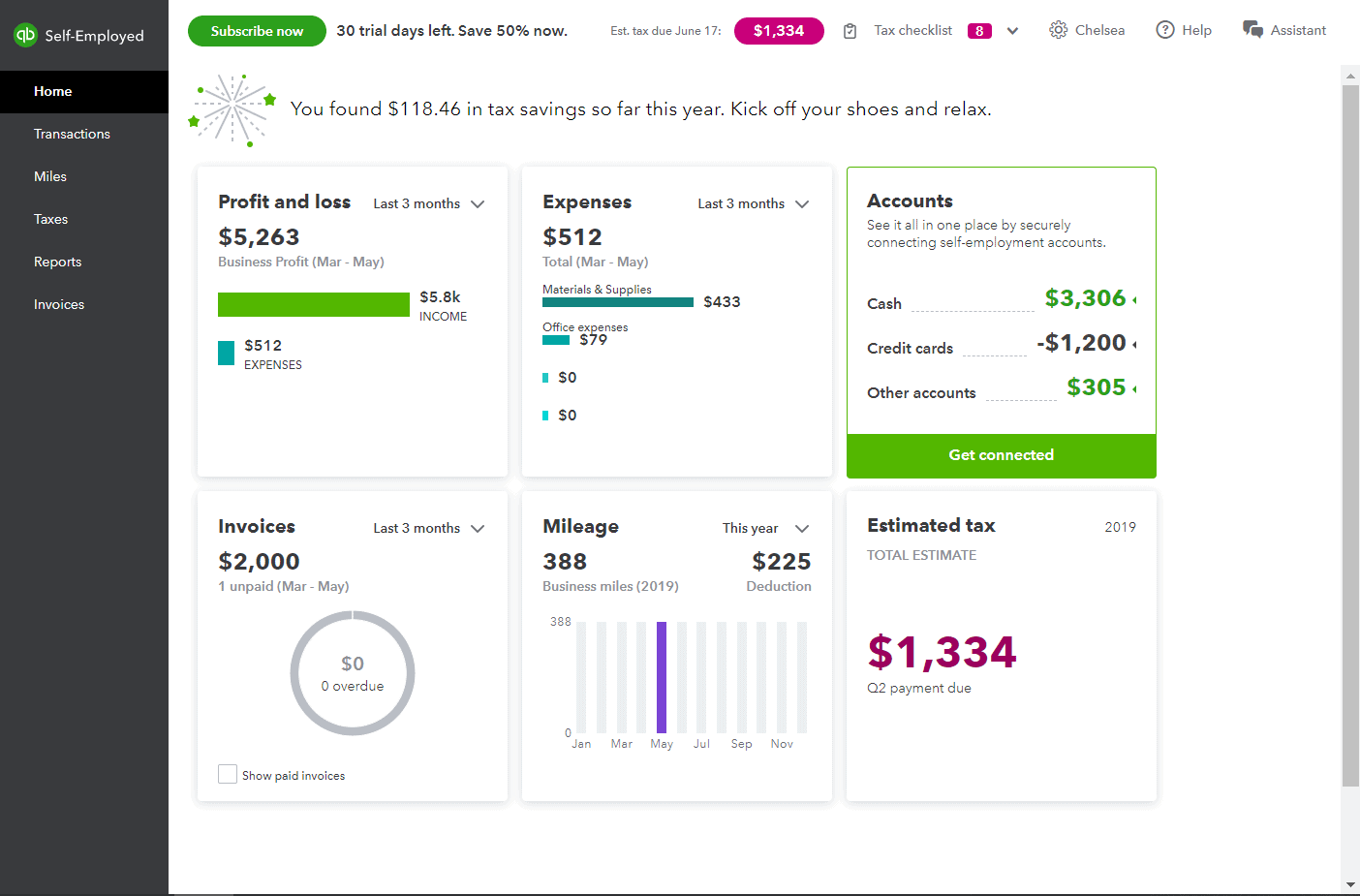

- Matching search results: Designed to help sole proprietors stay organized, QuickBooks Self-Employed packs quite a punch for the freelancer working alone. Its user-friendly and automated tools make keeping the books less of a chore while reducing the need for manual data …

- Source: 🔗

Details

3 QuickBooks Self-Employed Review 2022 – Business.org

- Author: business.org

- Published Date: 04/10/2022

- Review: 4.51 (468 vote)

- Summary: 3.6 · Review by Kylie McQuarrie

- Matching search results: Designed to help sole proprietors stay organized, QuickBooks Self-Employed packs quite a punch for the freelancer working alone. Its user-friendly and automated tools make keeping the books less of a chore while reducing the need for manual data …

- Source: 🔗

4 QuickBooks Self-Employed Review 2022 – advisor – Forbes

- Author: forbes.com

- Published Date: 01/03/2022

- Review: 4.22 (315 vote)

- Summary: · There are three plans available that cost between $15 and $35 per month. The cheapest one offers simple accounting software, and the more robust

- Matching search results: Designed to help sole proprietors stay organized, QuickBooks Self-Employed packs quite a punch for the freelancer working alone. Its user-friendly and automated tools make keeping the books less of a chore while reducing the need for manual data …

- Source: 🔗

5 QuickBooks Self-Employed Review 2022 – NerdWallet

- Author: nerdwallet.com

- Published Date: 08/06/2022

- Review: 4.03 (277 vote)

- Summary: Pricing ; Self-Employed. $15 per month. Automatically track mileage. Separate business and personal expenses. Automatically calculate quarterly estimated taxes

- Matching search results: Designed to help sole proprietors stay organized, QuickBooks Self-Employed packs quite a punch for the freelancer working alone. Its user-friendly and automated tools make keeping the books less of a chore while reducing the need for manual data …

- Source: 🔗

6 QuickBooks Self-Employed Review: Features & Pricing in 2022

- Author: fitsmallbusiness.com

- Published Date: 02/27/2022

- Review: 3.89 (599 vote)

- Summary: · QuickBooks Self-Employed has three pricing plans that range from $15 to $35 per month, depending on whether you want tax returns included and

- Matching search results: If you’re a freelancer needing a solid solution for tracking income and expenses, sign up and receive 50% off the first three months. However, if you anticipate outgrowing QuickBooks Self-Employed, we suggest that you go straight to QuickBooks …

- Source: 🔗

Details

7 QuickBooks Self-Employed Accounting Software Review

- Author: incorporationguru.com

- Published Date: 04/06/2022

- Review: 3.65 (222 vote)

- Summary: · QuickBooks Self-Employed starts at $15 per month, and there are also upgraded plans available for $25 or $35 monthly. The $15 package only

- Matching search results: QuickBooks Self-Employed offers customer assistance from 9 am to 9 pm ET every weekday. We’ve always received helpful and timely support from Intuit’s reps. That said, due to the massive size of this company, there isn’t much personalization …

- Source: 🔗

Details

8 QuickBooks Online Pricing: How Much Does QuickBooks Online Cost?

- Author: tech.co

- Published Date: 01/07/2022

- Review: 3.56 (258 vote)

- Summary: · QuickBooks pricing plans begin from just $15 per month for the Self Employed tier and run all the way to $200 per month for 25 users on the

- Matching search results: QuickBooks Self-Employed offers customer assistance from 9 am to 9 pm ET every weekday. We’ve always received helpful and timely support from Intuit’s reps. That said, due to the massive size of this company, there isn’t much personalization …

- Source: 🔗

9 QuickBooks Self-Employed vs QuickBooks Online

- Author: chamberofcommerce.org

- Published Date: 12/05/2021

- Review: 3.21 (365 vote)

- Summary: QuickBooks Self-Employed costs $15/month. There are limits to what it can do, however. The QuickBooks Self-Employed TurboTax Bundle is $25/month; QuickBooks

- Matching search results: This can have an impact on your tax deductions, especially if you’re a ridesharing or delivery driver. With Quickbooks Self-Employed, you’ll have a detailed record of all your trips. With the mobile app, you can even automate business mileage …

- Source: 🔗

Details

10 QuickBooks Self-Employed on the App Store – Apple

- Author: apps.apple.com

- Published Date: 12/21/2021

- Review: 3.05 (357 vote)

- Summary: Purchased TurboTax Self-Employed? Activate QuickBooks Self-Employed today at no extra cost. Already have QuickBooks Self-Employed on the web? The mobile app is

- Matching search results: This can have an impact on your tax deductions, especially if you’re a ridesharing or delivery driver. With Quickbooks Self-Employed, you’ll have a detailed record of all your trips. With the mobile app, you can even automate business mileage …

- Source: 🔗

11 Intuit QuickBooks Self-Employed Review – PCMag

- Author: pcmag.com

- Published Date: 12/06/2021

- Review: 2.89 (91 vote)

- Summary: 3.0 · Review by Kathy Yakal

- Matching search results: If you drive for work and can deduct the mileage, you can enter that specific expense by clicking the Miles link in the left vertical toolbar. You provide a few details about your vehicle(s), then about each trip. Each entry, of course, will need a …

- Source: 🔗

Details

12 QuickBooks Self Employed: Pros, cons, costs, and alternatives

- Author: wise.com

- Published Date: 01/17/2022

- Review: 2.78 (185 vote)

- Summary: · QuickBooks Self Employed: quick overview ; Price, Between $15 – $35 (3 subscription levels available). New users can get 50% off for the first

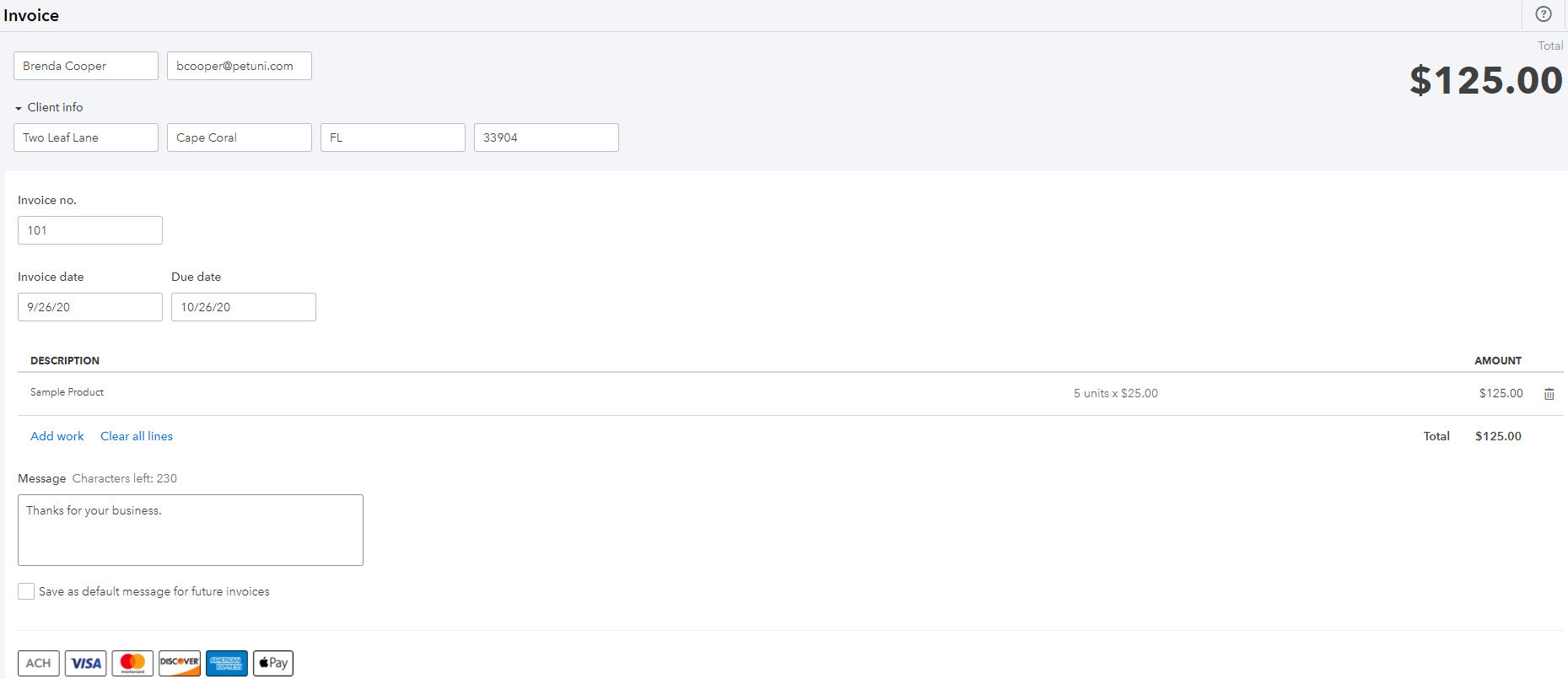

- Matching search results: It’s possible to create different categories for your transactions, so you can assign any payment from a particular client as business funds for example. You can also use this feature to account for recurring payments such as subscription payments …

- Source: 🔗

Details

13 Which Version of QuickBooks Should You Use?

- Author: businessnewsdaily.com

- Published Date: 01/29/2022

- Review: 2.62 (165 vote)

- Summary: Don’t try to save money by sharing one account among many employees. The entry-level QuickBooks versions, like Simple Start ($12) and QuickBooks Self-Employed

- Matching search results: It’s possible to create different categories for your transactions, so you can assign any payment from a particular client as business funds for example. You can also use this feature to account for recurring payments such as subscription payments …

- Source: 🔗

14 QuickBooks Self-Employed Reviews, Demo & Pricing – 2022

- Author: softwareadvice.com

- Published Date: 08/07/2022

- Review: 2.49 (86 vote)

- Summary: QuickBooks Self-Employed is a cloud-based accounting solution that helps small and midsize businesses across various industries to automate expense

- Matching search results: It’s possible to create different categories for your transactions, so you can assign any payment from a particular client as business funds for example. You can also use this feature to account for recurring payments such as subscription payments …

- Source: 🔗

15 QuickBooks Self-Employed Review: Tax Software for Business Owners

- Author: carefulcents.com

- Published Date: 07/08/2022

- Review: 2.42 (114 vote)

- Summary: QuickBooks Self-Employed Plans and Pricing · QuickBooks Self-Employed: $15 $7.50/month · QuickBooks

- Matching search results: It’s possible to create different categories for your transactions, so you can assign any payment from a particular client as business funds for example. You can also use this feature to account for recurring payments such as subscription payments …

- Source: 🔗

16 Pros And Cons Of Quickbooks Self Employed

- Author: tecbridgepa.org

- Published Date: 04/08/2022

- Review: 2.29 (95 vote)

- Summary: Plans And Pricing Of Quickbooks Self. If you are in the market for new accounting software, there are quite a

- Matching search results: New features since our last review include a specialized setup tool , simple time tracking, and tags. However, how much is quickbooks self employed despite these strengths, the site isn’t as capable as other accounting websites aimed at similar …

- Source: 🔗

Details

17 Self-Employed Accounting Software – QuickBooks – Intuit

- Author: quickbooks.intuit.com

- Published Date: 06/26/2022

- Review: 2.23 (72 vote)

- Summary: Each additional TurboTax Self-Employed federal tax filing is $119.99 and state tax filing is $44.99. Each additional TurboTax Live Self-Employed federal tax

- Matching search results: Self-Employed Tax Bundle: Discount available for the monthly price of QuickBooks Self-Employed Tax Bundle (“Bundle”) is for the first 3 months of service starting from date of enrollment, followed by the then-current fee for the service. Your …

- Source: 🔗

Details

18 QuickBooks Self-Employed Review – Features, Pricing & Tutorials

- Author: wizxpert.com

- Published Date: 04/15/2022

- Review: 2.27 (78 vote)

- Summary: · Self-Employed is the most basic version of QuickBooks Self-Employed. It comes at only $7.5 per month. … Surprisingly, it has a very low cost but

- Matching search results: Self-Employed Tax Bundle: Discount available for the monthly price of QuickBooks Self-Employed Tax Bundle (“Bundle”) is for the first 3 months of service starting from date of enrollment, followed by the then-current fee for the service. Your …

- Source: 🔗

19 QuickBooks Self Employed Review – ChooseWhat.com

- Author: quickbooks.choosewhat.com

- Published Date: 12/01/2021

- Review: 2.19 (123 vote)

- Summary: QuickBooks Self Employed is the least expensive bookkeeping product offered by QuickBooks. The service has a retail price of $10.00/ month,

- Matching search results: QuickBooks Self Employed is incredibly easy to use, but phone support is completely unavailable, and it doesn’t integrate with any other versions of QuickBooks or allow you to import any customer data. Also, this is an online only product, …

- Source: 🔗

Details

20 A Freelancers Guide to QuickBooks Self-Employed

- Author: gigworker.com

- Published Date: 01/15/2022

- Review: 2 (131 vote)

- Summary: · QuickBooks Self-Employed (QBSE) is online software that makes accounting duties more manageable and organized for freelancers or those in

- Matching search results: QuickBooks Self Employed is incredibly easy to use, but phone support is completely unavailable, and it doesn’t integrate with any other versions of QuickBooks or allow you to import any customer data. Also, this is an online only product, …

- Source: 🔗

Details

21 Online QuickBooks Self Employed – Wondershare PDFelement

- Author: pdf.wondershare.com

- Published Date: 01/27/2022

- Review: 1.95 (98 vote)

- Summary: QuickBooks self-employed cost; QuickBooks self-employed has two pricing options – one that is just QuickBooks self-employed and the other which has

- Matching search results: With Intuit QuickBooks self-employed, freelancer can save around 8 hours a month managing their finances. Here you can track mileage, save money by the mile, while also reserving the chance of driving up your tax deductions with automatic tracking. …

- Source: 🔗

Details